Good afternoon folks! I hope you have been doing well.

I wanted to update you on the market & some important things that may interest you!

As of Friday the market being (SP500) closed near its 50 moving average for the first time in a long time! This is an important level for many reasons in the short term. Its also been noted that we started to move away from its rounding top its been creating for some weeks.

These rounding tops & consolidation pullbacks are some of the hardest & challenging times to trade but they are important for overall trend health.

I’m going to go over some key levels I’m watching moving forward in a bit.

I want to highlight some notable sell events that took place on Thursday APRIL 4th This day was a first time in a long time I noticed aggressive selling happen across the board. I mentioned my thoughts about this in the inner circle & took to SPY puts that week as a hedge. Sometimes when there is selling its in short term waves. That day resonated with me as a day to be cautious moving forward.

The second notable day to me was on Tuesday APRIL 9th. This day I saw selling again, however it was quickly bought back up to return to a mostly flat day overall..

What was key about this day, it was aggressive selling & it recovered mostly, but never could get buyers back ABOVE those two selling events.

The third day was Friday April 12. Another day of selling that took the market lower into its 50 moving averages. This is an investors domain for looking for value. But will it hold? Only time will tell here.

Why did I notate those 3 selling events? Because often times large selling comes in waves or ripples. (Same thing happens when they are buying up the mkt…)

For now its important to know those areas

For ES_F 5274s

For SPY its 519.5s

For SPX its 5259s

For QQQ its 448s

All areas that would need to be reclaimed for those big sell areas to be taken back over by buyers to hike.. This is a temporary ceiling in the mkt.

There is a current rounding top formed inside those levels also..

What does this mean?

It means simply we have a temporary top in UNTIL those levels can once again be taken out & act as support. Rounding tops are short term tops. They are choppier areas to trade. Often they can last a few weeks or more & often some of the worst trading have happen in rounding tops or rounding bottoms.

Just as I wrote about rounding bottoms back before this large multi month hike higher, it was terribly choppy before the mkt could hike & trend. This is a natural part of trading & often when most traders get chopped up easily.

All in all, when the mkt is consolidating in any form its key for me to do less & pick entries like a sniper. You can see false breakdowns & breakouts on rounding patterns in any market & those signs have been present for a few weeks with a harder to trade tape.

My rule of thumb in trading is this:" If its hard action to trade, Just do less. Cash is still a position. No need to force hard plays, Not much good comes from it..

Moving on…

I’m going to go over some levels I’m watching on the mkt below now…

Above is SPX you can see the uptrend on the daily break & this went into a consolidation / rounding top formation. Whats key here for me now is this..

In the short term, SPX would need to reclaim the 5200s to hike this back up into that 5259s I mentioned which was supply. Its harder for longs & calls initially as long as this is below those. If the immediate support at the 5140s fails to hold, this can drop lower in the range next.

Killzone is an area of higher liquidity & consolidation. It has a 5140-5200 range that could be more challenging as a whole & better for scalping/ day trading imo..

As for Trend health. This is rated as a 2/2 Mixed trend on my rating scale. It means there is a monthly/Weekly trend intact for now But the daily & 2 hr. have pulled back and are more bearish in that short term.

Below is the SPY, Similar to the SPX it broke its uptrend & is in a rounding top formation. Whats key in the short term for SPY bulls is trying to reclaim & hike this at the 514.5s. If they can, then they could retest that 519.5 ranged I mentioned before.

Otherwise I have to watch this next support at the 509.25s. If that doesn’t hold, then more downside is immanent.

Overall kill zone on this right now is the 514.5-509.25 which can act as a harder to trade range overall..

Trend health, this is a 2/2 mixed trend also. Monthly & weekly is in tact for now & the daily & 2 hr. is in a bearish pullback.

Keep in mind rounding tops do not mean the mkt cant correct lower or hike higher, they can stay in a larger consolidation range also if they want. We do not get to decide the markets next move. We can only be aware of the current state & follow the money from there. I’m simply relaying that there was notable sellers on the mkt & it has been trading in a rounding top formation & the levels I’m watching next.

Below is the QQQ this one has been terrible to trade out of them all… Its been a scalper tape, the range has been very tight. This did veer off trend also & has formed a rounding top with the 448s as overhead supply. This is the level bulls must take out to get out of this upper range. For now its a temporary ceiling like the other two names vie mentioned already..

The Kill zone in QQQ is much larger notably with the 448s as the high end resistance & the 434.75s as the low end support. Until it can break this range It will continue to be a challenge to trade.

Trend health this is a 2/2 mixed trend also. Monthly/Weekly are bullish to me & the daily/ 2hr are more bearish. Keep in mind if it stays in this range, nothing improves, its just greater consolidation. Below the 434.75s this can move lower from the range & the wheels could get more traction of movement.

IWM has uniquely traded differently also. Its been using the 200 level for some time as a major support pivot. Once it loses that, it can move lower of course. Above 205.5s this improves to move higher. Another name in a range.

Killzone is the 205.5-200s for some time. Its a harder to trade liquidity level.

Trend health is a 2/2 mixed trend also. This means the higher frames like the monthly/weekly are still bullish & the daily/2hr are weaker & currently dipping back a bit.

My trend system & how I track all the FANNG Names & the market itself (SPY ES QQQ IWM) are updated daily now in my Private feed in my morning market notes in my Discord.

You can stay update & get them as trends start to shift in a day to day basis.

Some big updates over the last few months I wanted to share quickly…

A couple huge updates below!

MINT A.I. Has started implementing MINT AI Swings AND MINT A.I. Shares (equity based triggers with stops)

These are idea new idea generators in the discord..

Here are a couple recent Swing triggers

TSM swing above was triggered on 2/26/24 on the TSM 4/19 135c at $5.00. They went to $14.43 after trigger. A +188% move on the options side!

Another one was OXY Swing on 3/11/24 on the 4/19 62.5c at 1.43. They went to $8.71 after trigger. A +510% move on the options side!

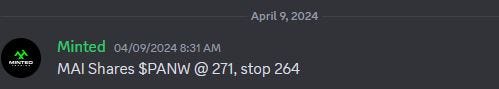

MINT A.I. Shares was just introduced last week & already some nice plays are starting to come out of there.. These are unique as it aims for a directional move also, but MAI includes a hard stop placement based on its own Idea.

PANW was the first play that triggered

PANW Triggered on 4/9/24 at $271 & so far has went to $285.49 a +5.35% move on shares w/o a drawdown.

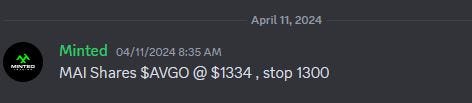

AVGO was another big hit in such a short period of time w/o a drawdown period.

AVGO triggered on 4/11/24 at $1334 & so far has went to $1391.87 for a +4.34% move in 1 day.

I have high hopes for MINT A.I. Ideas. Not every play will win or be a success but that’s because No system is failproof or foolproof & individual results will always vary.

Its just nice to have ideas come in from all areas of the mkt.

From MINT A.I. options ideas, SPX Cluster bets (tape derived) To Swings & now Equity.. Pare all that with MINT Education, traders have an edge that is unique & not found anywhere else!

Last note form me today!

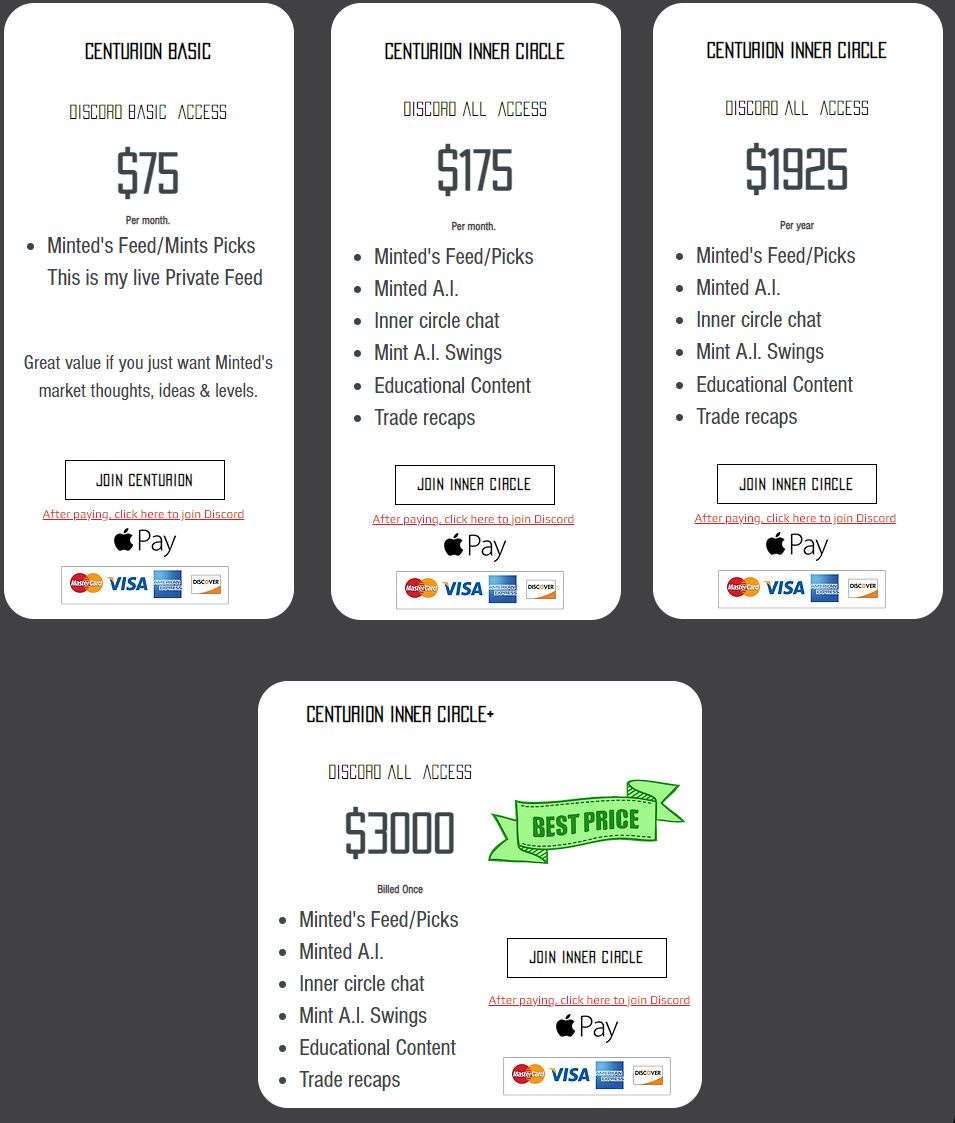

I am currently running some short term Spring specials.

If you are wanting to save some money, educate & get inside the centurion inner circle with me on a daily basis,

Check out these special prices below!

Many have asked about YEARLY pricing, so here it is.. You can sign up for 1 year & essentially get a month free.

Also Back by popular demand is the Onetime price (lifetime). I will remove that offer after a while, So if its something you think you want, get it while its there. Its truly the best price & value for everything I have to offer!

You can sign up for any tier here on my website. See you in the inner circle!

-Get Minted!